Powered by the Central Bank of Brazil, PIX is an instant payment system where funds are transferred between accounts within seconds and at any time of the day.

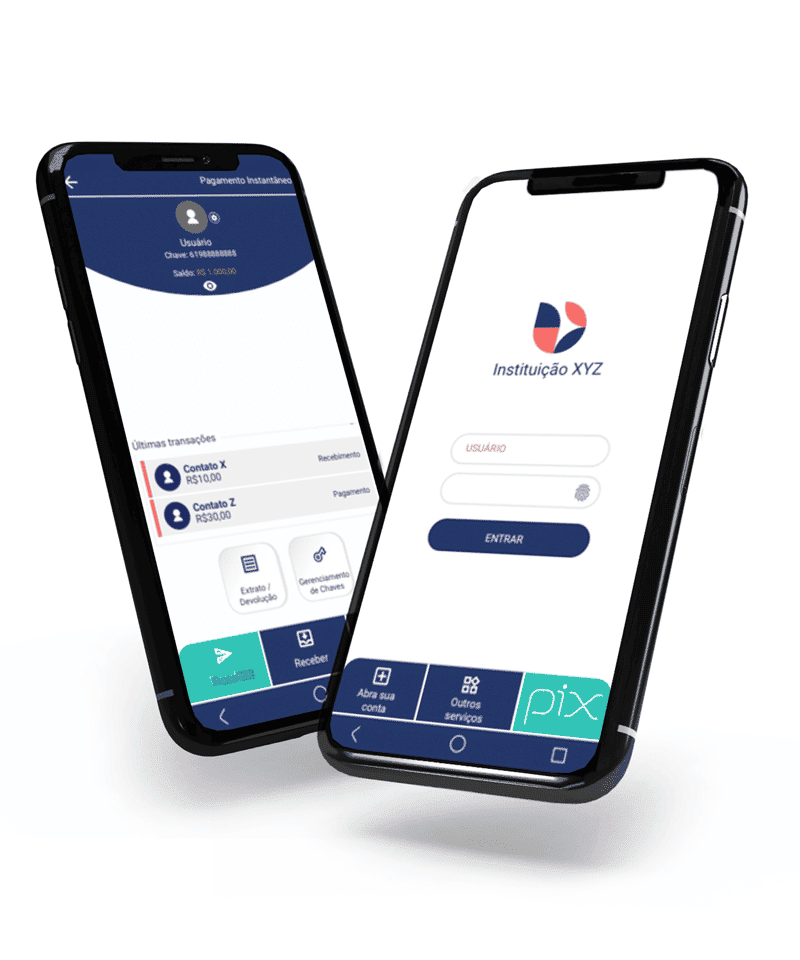

Cyberbank integrates PIX payments to enable a faster and more flexible user experience for day-to-day customer transfers.

The integration of PIX into Cyberbank allows:

- Generating payments via static and dynamic QR code for payments and money collections.

- Using registration in DICT (Diretório de Identificadores de Contas Transacionais) to use telephone numbers to make transfers.

- Integrating the PIX interface within Cyberbank, which allows payment at retail partners and access to all capabilities that are inserted for Internet banking.

Key Benefits:

- It boosts the efficiency of payment methods, increasing the feeling of customer satisfaction.

- Costs are reduced, increasing security and improving customer experience.

- The integration enables finance to be included into sectors previously unreached by banking.

- PIX at Cyberbank allows users to offer a payment system that matches the speed currently demanded by customers.

Key Features:

- 24/7 availability every day of the week, including holidays.

- It is a cost-effective system that does not involve fees for users making transfers.

- PIX Payments allows interbank payment and transfer.

- The payment security system is reinforced by Cyberbank’s self-defending bank initiative, securing every transaction processed.

- All critical information for reconciliation may be submitted along with the payment order, thus making process automation and payment reconciliation easier.

PIX supports:

- Transfers between individuals, government entities, and companies.

- Transfers between checking, savings, and prepaid accounts.

- Use of iOS and Android mobile devices with camera access for QR code capturing.

- Generation of unique DICT code for each user.

- Payment in commercial establishments, including physical stores and e-commerce.

- Payment of service providers; intercompany payment, such as supplier payments, for example; collection of revenues from Federal Public Organizations such as fees (court costs, passport issuance, etc.), public real estate rents, administrative and educational services, fines, among others (these collections may be made through PagTesouro).

- Payment of utility bills, such as electricity, telecommunications (cell phone, Internet, cable TV, landline phone) and water supply.