Dynamic Yield

Founded in 2011 in New York, USA, Dynamic Yield helps banks quickly deliver and test personalized, optimized and synchronized digital interactions from customers. Marketing, product, development and e-commerce teams from more than 350 global companies are using Dynamic Yield’s experience optimization platform as a technological layer at the top of existing CMS or Commerce solutions.

Dynamic Yield is presented as a solution to generate personalized marketing campaigns, which fit the needs of the business and each client.

Some of the key features in Dynamic Yield are:

Customer segmentation: allows banks and financial institutions to capture and analyze key data about anonymous and known visitors, using them to establish deeper relationships with each customer based on affinity, traits, current interests, previous behavior and more.

Personalization and targeting: experience personalization capabilities allow banks and financial institutions to attract and retain customers, responding to the behaviors, attitudes and needs of each customer with a more meaningful, relevant and valuable real-time personalization for existing and potential banking users.

Testing and optimization: through this tool banks and financial institutions can optimize the impact of their marketing strategies, allowing access to test, optimize and continuously adapt customer experiences to offer services, products and offers based on relevant information.

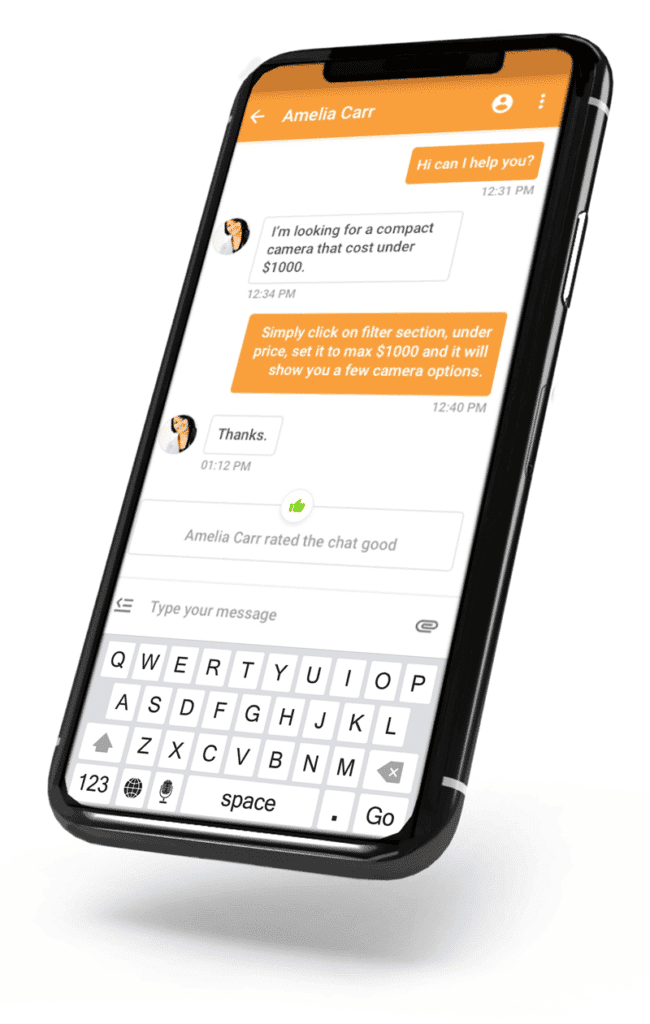

Behavioral messaging: a key capability from the integration between Dynamic Yield and Cyberbank is the orchestration of strategies for generating different marketing messages across multiple touchpoints; engaging customers with targeted notifications and overlapping messages to inform them about a wide variety of financial products or any other information, encouraging them to make immediate decisions.

Triggering system: a key benefit provided by this integration is the construction of long-term relationships with the customer, beyond the web experience. The system automates the sending of trigger marketing emails in a timely manner, as well as push notifications based on behaviors and needs captured in real time.