Based in Dublin, Ireland, Antuar is a company driven by developing technology that brings banks closer to the digital age, achieving a huge breakthrough in the delivery of services and products that improve from end-to-end the quality of channels and customer touchpoints.

The integration of Cyberbank and Antuar enables financial institutions to innovate the branch network through a suite of products and services that deliver meaningful customer engagement at the point of contact.

The integration of Antuar and Cyberbank can help:

- Offer greater levels of customer self-service and a more empowered branch staff through the digitization of branch services.

- Provide tailored financial products to customers at point of need on any given sale or service journey.

- Manage customer interactions and service requests from start to finish in any engagement channel, including the branch.

Key Benefits:

- Assisted self-service solution: The solution gives customers branch automation while maintaining human contact. Staff can assist IF needed from a tablet (or PC) for approving transactions, validating checks, answering questions, etc.

- In branch engage: Customer engagement product that tracks service requests and sales opportunities through their life cycle, ensuring that banks don’t miss a sale or service opportunity.

- Full service teller: Intuitive, relationship-centric, branch transaction processing application proven to increase staff utilization and promote the sale of new financial products.

- Devices: Connects tellers (or other application) software to the branch peripherals to automate functionality from cash recyclers and check scanners to authentication devices and printers.

Antuar can support:

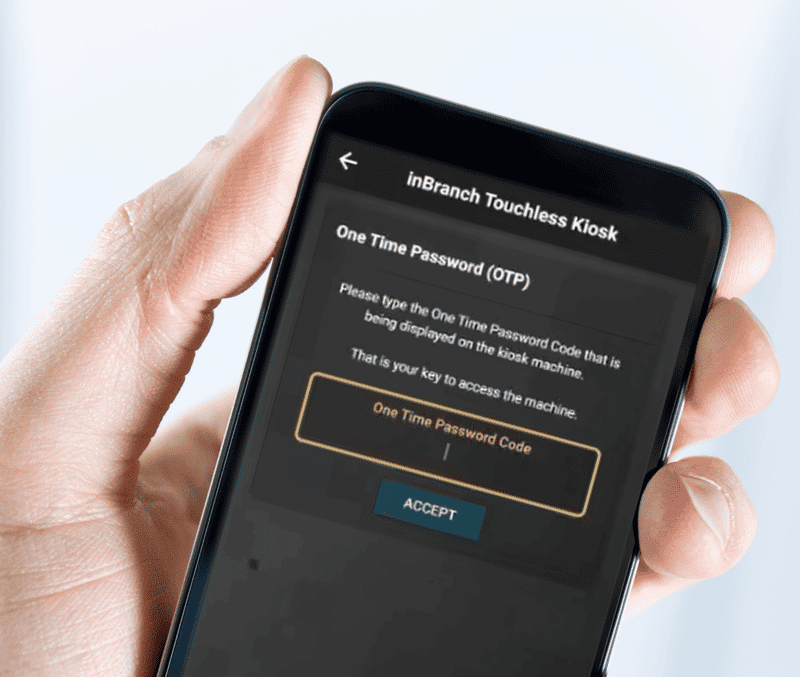

- Mobile control over the kiosks to have touchless access to the branch kiosk, using QR codes to validate the user.

- Core agnostic: connect to any core system.

- Remote client assistance with video: for drive-ups, or off-hours.

- 90% of financial transactions in the branch can be automated.

- Reduce the cost of transactions performed at the branch by 75%.

- Pandemic planning: service with social distance guidelines.

Antuar can support:

- Server Based Solution: Business logic is put on a server in a customer’s data center. Customers can select their preferred kiosk machines into their own network in any location wanted. The protocol connects the server to the back office systems including the core and CRM; opening a browser on each kiosk and pointing it at that server.

- Client Transactions: The solution runs on the customer network, connecting the core system. Clients can access all of their accounts and do all the transactions available on the teller system, including printing checks. All transactions are driven by the software, working independently from the staff.

- Branch Control: Each machine acts as a teller using the same teller logic and transaction interfaces; this gives vision of the cash position on the machine and in the branch all the time.

- Hardware Agnostic: The solution inBranch Kiosk is independent to any hardware provider. Customers can pick the machines that are most appropriate for the services wanted to deliver to their users. The software can run on different hardware solutions provided by Glory, GRG, Hyosung, Source Technologies, and more.