Founded in 2001, Ensenta is pioneer of innovative enterprise-wide, real time SaaS solutions for mobile and online payments and deposits. Their Smarter & Safer™ payment technologies not only mitigate risk, they minimize compliance exposure, increase back office efficiencies, and improve funds availability for consumers and businesses.

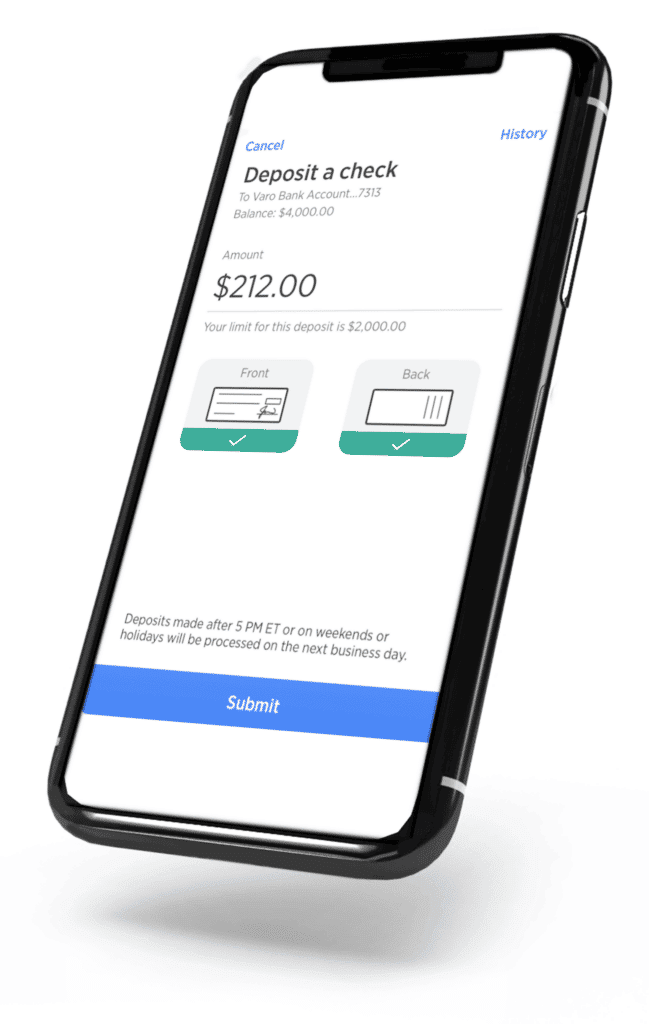

Cyberbank integrates Ensenta to safely capture and process check deposits via mobile apps, ensuring for these deposits a complete and effective life cycle.

The integration of Ensenta and Cyberbank can help:

- Ensure an optimized check validation.

- Deliver digital depositing tools that allow customers to gain time from remote banking.

- Ensenta delivers a fully customizable product, just as Cyberbank’s focus is on giving the best user experience, guiding the user through the process to make it user-friendly.

- Secure mobile deposits under the regulations and compliance relevant to the region in which it is used.

Key Benefits:

- Provide secured mobile deposits with identity verification.

- Be 100% digital remote banking with no personal visits required.

- Be available for every device wanted (laptop, mobile and tablet).

- Be 100% paperless with no paper forms or contracts to sign.

Key Features:

- Interactive real time messaging to help users correct and complete deposits.

- Check amounts are automatically read and totals are balanced.

- Checks can be edited or deleted in the same session without starting the deposit over.

- Multicheck deposits can be real. With Ensenta and Cyberbank users can simply place the front of the first check under the camera, flip to the back, and repeat for each additional check.

- Endorsement detection: detects the presence of an endorsement on the back of a check.

- CAR/LAR matching: Courtesy Amount Recognition and Legal amount Recognition, ensures the numerical and the written amounts match.

- Front and back matching: this feature leverages Harland Clarke PhotoSafe checks.

- Immediate validation of Magnetic Ink Character recognition code, known in short as MICR code.

- Enhanced Analytics are available for reporting and audience.

- Manage risk with 200+ risk filters, Smart Limits™, Smart Holds™, roles and entitlements, duplicate detection, and calls to 3rd party risk services to see if the account is open or closed.

Ensenta can support:

- IOs and Android devices.

- API centric model features real time connectivity.

- Ensenta adapts seamlessly to the capabilities of the device camera, using the auto-focus and automatically using the torch/flash mechanism to aid the end user in capturing a more usable document.

- Video auto-capture mode uses the device’s (camera or webcam) video-stream to acquire images for initial analysis on the device. This analysis identifies a document by locating its corners, making sure the entire document is visible, in focus, and appropriately rectangular based on the input parameters established.

- Ensenta provides an easy solution for high volume business deposits by supporting industry leading check scanners including Canon, Digital Check, Panini, Burroughs, Epson, and RDM.