Plaid, an American company based in California, provides companies with the necessary tools to develop a digitally-enabled financial system, helping to modernize banking infrastructure.

The Cyberbank and Plaid integration allows customers to link their accounts into one place, with the addition to make round ups to save money with every payment or money movement. This setup is designed to save time and give a friendly user experience to financial institutions customers, where all the needs are covered by Cyberbank.

The integration of Plaid and Cyberbank can help:

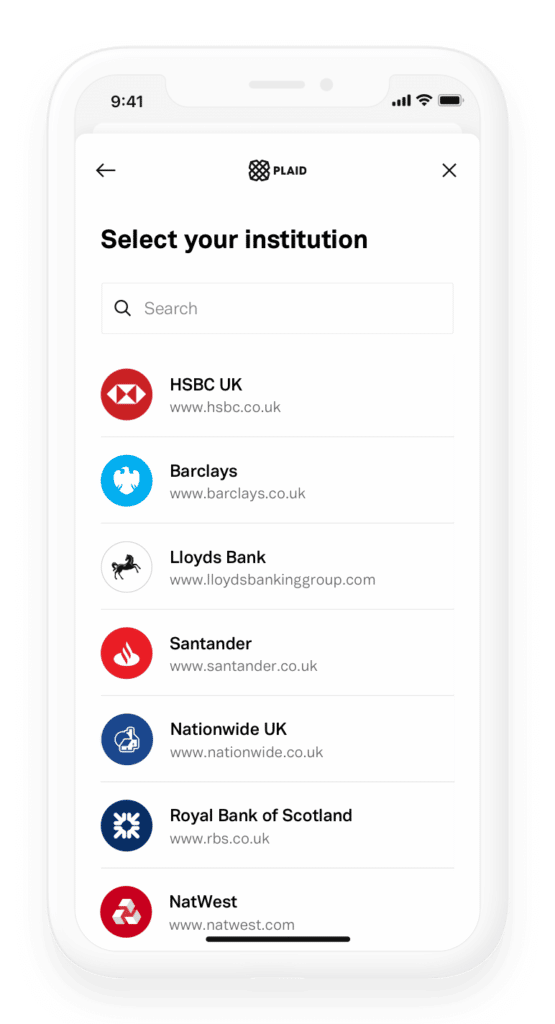

- Securely add bank accounts into the banking app

- Visualize credit cards, chequing, or savings accounts under your connected banks screens

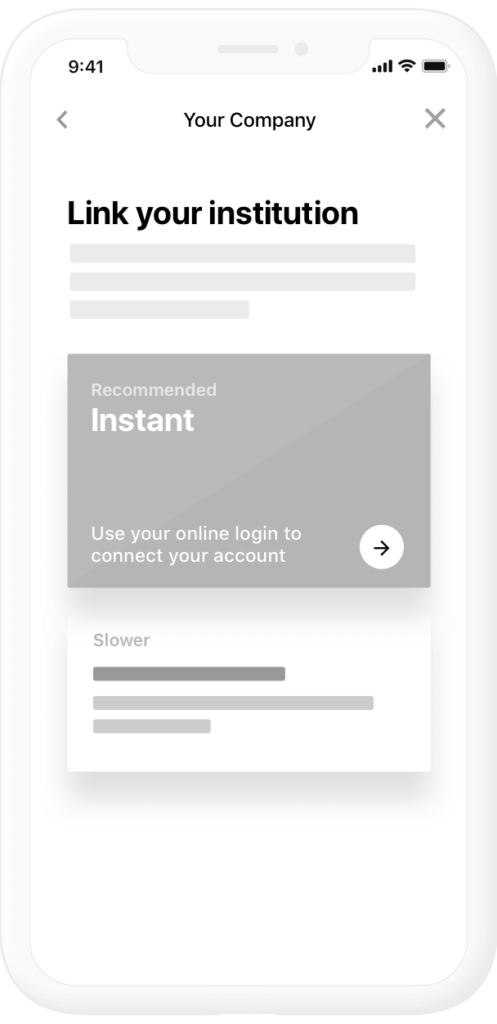

- User experience is proved to be smooth with every transition and workflow to connect and disconnect bank accounts in a few easy steps

- This integration provides instant connection between bank accounts, strengthening the engagement and loyalty of each customer

- With every transaction or payment customers can round up to save money, the financial institutions can manage and customize the minimum and maximum of the amounts allowed, transferring automatically every movement into the account selected by the user (except for credit cards accounts)

Key Benefits:

- On average it takes 11.5 seconds for users to open the app, find their new bank account and add it with the username and credentials of the other institutions

- Financial institutions can get user-permissioned bank data to perform analytics and plug-it with other tools

- Easy connection with a few lines of code to add the integration and customize the look and feel of the brand

Key Features:

- Account opening and account funding: Auth retrieves account and routing information instantly when users connect their account using login credentials. Plaid works with any ACH processor, including Stripe and Dwolla, to enable fast and frictionless account funding

- User experience: Balance instantly checks whether users have the funds to make a successful payment; increase user accounts funding rate with a seamless balance check

- Sign-ups risk mitigation: Identity confirms users’ identities with what’s on file at the bank such as their name, phone number, address, and email

Plaid can support:

- Instant Authentication with Auth:

- Instantly authenticate accounts: Retrieve account and routing numbers when users connect their checking or savings accounts using bank credentials

- Connect accounts from any US bank: Set up ACH transfers from any bank or credit union in the US

- Set up frictionless payments: Plaid works with any ACH processor, including Stripe and Dwolla

- Identity:

- Verify user identities using bank data: Retrieve user names, phone numbers, addresses, and emails for individual and joint accounts, data can be used to complement the KYC process

- Personalize onboarding forms: Auto-fill forms with identity data when users link their bank accounts