OneSpan

Set up in Chicago in 1997, OneSpan started business developing a platform to support financial institutions in their digital transformation processes. Providing support from client digital onboarding up to fraud mitigation and management of digital process flows, OneSpan open platform reduces costs, accelerating customer acquisition and increasing their satisfaction.

OneSpan may integrate Cyberbank to provide a user experience without friction and totally safe. The solution focuses on fraud analysis, e-signature, authentication, and user protection, therefore, a flexible system—with all the capabilities required by banks—is developed to deliver user-friendly experiences to their customers.

OneSpan integration with Cyberbank makes it possible to:

- Obtain a robust end-to-end security system for the customer onboarding process.

- Provide different types of identity authentication perfectly consistent with any device used by the customer.

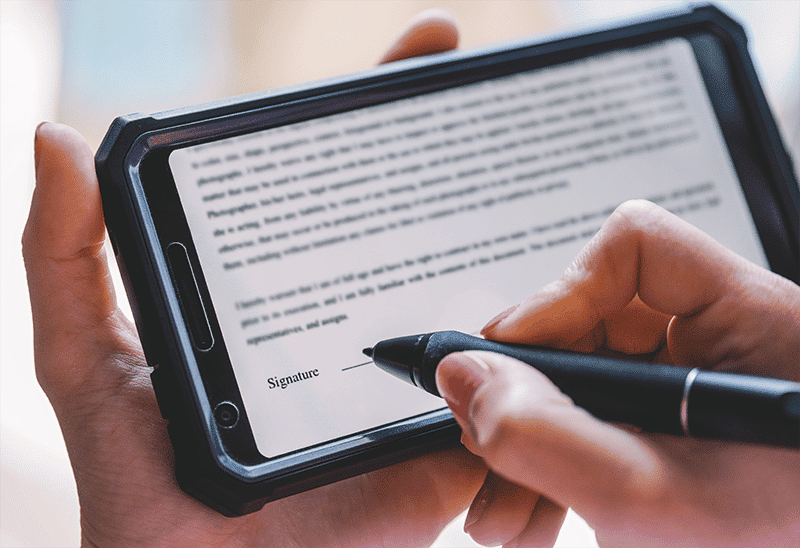

- Display on the screen the documentation to be signed by the customer, making the users save time and paper.

Key Benefits:

- Cyberbank digital application is flexible enough to display OneSpan integration on screen where the documents to be signed are shown. They can be pre-designed so that it is possible to add the signature sections in the document. In addition, it can previously select the interested parties (user, bank agent, notary public, etc.) who will sign the document.

- The integration allows using a platform with IA capabilities and identity authentication biometrics.

- OneSpan and Cyberbank collaborative work enables banks to comply with all KYC requirements.

- The platform ensures a 100 % digital onboarding, helping customers to spend less time on branch visits, and to increase loyalty.

- All the security systems are supported by key regulations and certifications to comply with the legal requirements of each country.

Key Features:

- Flexibility: OneSpan uses flexible security systems, that is to say, the bank decides which security methods it wants to include for the users’ access. This way, it avoids using rigid self-imposed systems that only generate friction.

- Authentication methods management: The platform easily integrates multiple authentication technologies to ensure that the correct method is available for specific applications.

- Protected mobile channel: The system mitigates mobile attacks, providing frictionless security through the native integration of application shielding.

- Integrated biometrics: OneSpan uses a more reliable and convenient authentication system, by means of fingerprint scan and facial recognition.

- Smart use of machine learning: To better detect fraud in real time and reduce false positives, One Span uses a risk analysis engine with automatic learning.

- Efficient electronic signature: The e-signature service enables banks to generate easy-to-sign documents. Users can sign them using a smartphone (IOs and Android). In case it is necessary to have more space to sign, customers can use the screen vertically, or simply accept the terms of the document, clicking a pre-designed button.

OnSpan helps through:

- Monitoring risky mobile devices to identify fraudulent activity based on transactions data and the beneficiaries payment history.

- Monitoring malware activity, analyzing potential signs of malware in sensitive and non-sensitive activity, such as transactions, login, registration, change of address, etc.

- Multi layer monitoring for the analysis of devices, applications, behavior, and historical data, as well as digital channels and server analysis.

- Fraud visualization interactive tools identify rapidly the origin, destination, device and location of possible fraudulent transactions.

- Mitigation of account theft.

- Compliance with SOC 2 Type II, ISO/IEC 27001:2013, ISO/IEC 27017:2015, ISO/IEC 27018:2019, FedRAMP, Health Insurance Portability and Accountability Act of 1996 (HIPAA), Skyhigh Enterprise-Ready, ESIGN Act (Electronic Signatures in Global and National Commerce Act), UETA Act (Uniform Electronic Transactions Act), eIDAS (Electronic Identification and Trusted Services Regulation).