MX

Based in Utah, United States, MX Technologies is a fintech company that aims to connect people with their financial data so that it automates their money experience. It enables fintech and financial institutions to aggregate, enhance, analyze, present, and operate financial data.

The integration of Cyberbank and MX drives customer-centric banking relationships by gathering and providing data and transforming it into useful information, which makes it possible to create profitable account holders.

Advantages of Cyberbank and MX integration:

- Personal Financial Management (PFM): Customers can make better financial decisions in real-time with AI-driven personalized insights, all the data covered by Cyberbank and pushed to the MX engines.

- Data Aggregation: Also known as Financial Data Aggregation, it is a method that involves compiling information from different accounts, such as bank accounts, credit card accounts, investment accounts, and other consumption or business accounts, in a single digital environment.

- Analytics: AI decisions with real-time insights into customer financial data, to empower businesses to create strategies based on customer metrics.

Main Benefits:

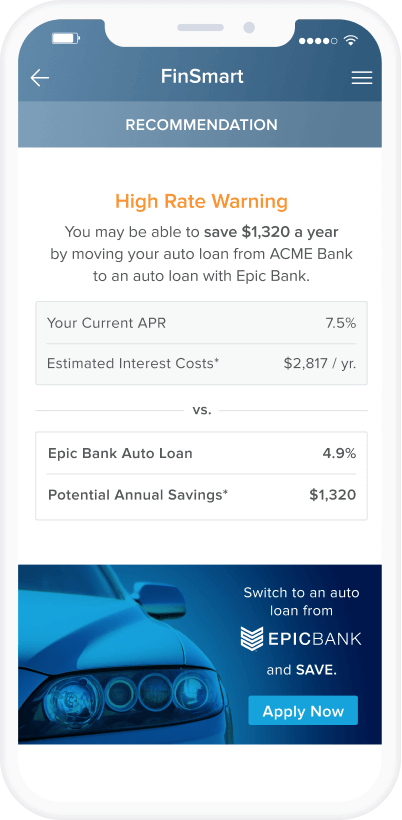

- Increase adoption and engagement with an easy-to-use UI and personalized insights. By means of financial health scores, organizations can easily segment customers, based on individual needs. They can also provide customized offers and messages that empower their customers to be financially strong.

- All in one environment, through data aggregation, customers can link their accounts and manage all data included in the financial institutions they are affiliated with, just adding their banking credentials into the platform.

- The analytics service can reveal crucial information to develop product offerings that meet the customers’ needs and impact strategic points of the customer journey.

Key Features:

- MX’s PFM solution, MoneyMap: It can be securely integrated into digital banking products, providing customers with a seamless experience for viewing all their data on a single platform.

- Accounts connection: With financial data aggregation, customers can view all their accounts in one environment.

- Subscription tracking: It automatically detects subscriptions, monthly costs, the annual total of each subscription and notifies the customer of any increase or decrease in monthly costs.

- Financial insights: Each transaction is displayed according to income and expense categories through a comprehensive user interface.

- AI: Real-time AI-driven financial insights and advice, as well as self-learning analytics, continuously improve the information presented.

- Communication: The customer receives notifications and alerts from across all accounts.

MX makes it possible to:

- Support modules like budgeting, account aggregation, auto-categorization, debt management, and others that drive profitable growth.

- Through account aggregation, have access to:

- Transactions

- Investments

- Account Verification

- Identity Verification

- Assets

- Liabilities

- Balances

- PDF Statements

- Count on Open Bank connections, replacing credentials with tokens.

- Through MX Connect Widget, increase the number of accounts aggregated per user with a backend that increases aggregation rates and a user interface that prompts users to connect more accounts.

- Increase share of wallet: Competitive dashboards give visibility into where customers have other accounts, what types of accounts they are, their respective balances, and interest rates. This allows targeting them with relevant offers and incentives.